Estate Planning Attorney Fundamentals Explained

Estate Planning Attorney Fundamentals Explained

Blog Article

Facts About Estate Planning Attorney Revealed

Table of ContentsTop Guidelines Of Estate Planning AttorneySome Known Incorrect Statements About Estate Planning Attorney How Estate Planning Attorney can Save You Time, Stress, and Money.The Definitive Guide to Estate Planning Attorney

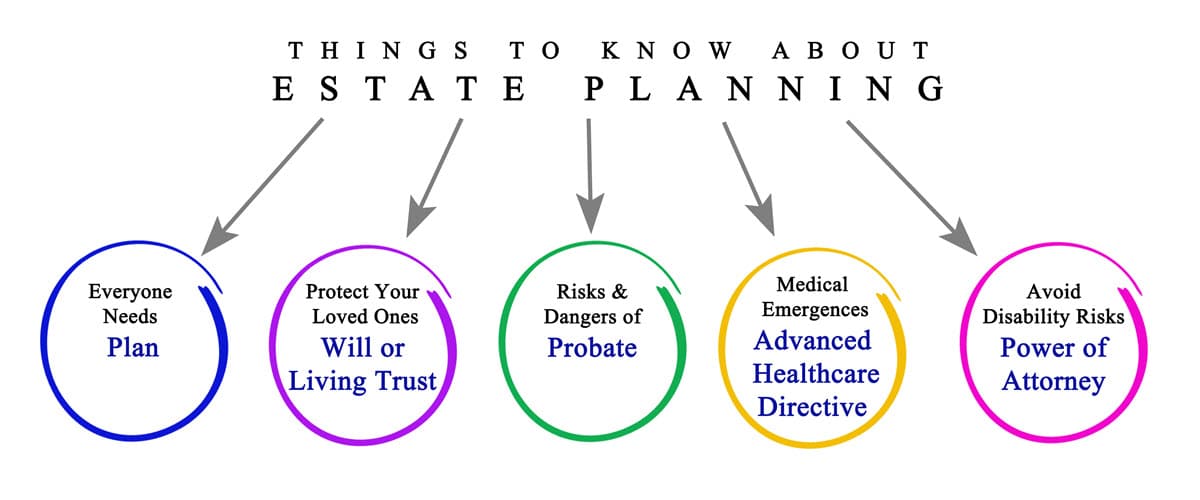

Estate preparation is an action plan you can make use of to determine what occurs to your assets and responsibilities while you're active and after you die. A will, on the various other hand, is a lawful file that describes how assets are dispersed, that cares for youngsters and family pets, and any type of various other dreams after you die.

The administrator likewise needs to pay off any type of taxes and financial obligation owed by the deceased from the estate. Financial institutions typically have a minimal amount of time from the day they were informed of the testator's fatality to make cases against the estate for cash owed to them. Claims that are turned down by the administrator can be taken to court where a probate judge will have the last word regarding whether or not the claim stands.

Rumored Buzz on Estate Planning Attorney

After the supply of the estate has been taken, the value of assets determined, and taxes and financial debt paid off, the executor will certainly then look for authorization from the court to disperse whatever is left of the estate to the recipients. Any type of inheritance tax that are pending will come due within 9 months of the date of fatality.

Each specific places their possessions in the depend on and names somebody other than their partner as the beneficiary., to support grandchildrens' education.

The 3-Minute Rule for Estate Planning Attorney

This method includes cold the value of an asset at its value on the day of transfer. Accordingly, the amount of prospective capital gain at death is likewise frozen, permitting the estate organizer to approximate their possible tax liability upon fatality and much better prepare for the settlement of revenue tax obligations.

If enough insurance coverage profits are available and the policies are properly structured, any kind of income tax obligation on the deemed personalities of possessions following the death of an individual can YOURURL.com be paid without resorting to the sale of assets. Profits from life insurance that are gotten by the beneficiaries upon the fatality of the guaranteed are normally revenue tax-free.

Other costs related to estate preparation consist of the preparation of a will, which can be as reduced as a couple of hundred dollars if you utilize among the finest online will certainly makers. There are certain records you'll need as part of the estate planning process - Estate Planning Attorney. Some of one of the most usual ones include wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is just for high-net-worth individuals. Estate intending makes it simpler for individuals to establish their wishes prior to and after they pass away.

Getting The Estate Planning Attorney To Work

You need to begin preparing for your estate as soon as you have any quantifiable possession base. It's a recurring process: as life advances, your estate strategy ought to shift to match your scenarios, in line with your new goals.

Estate preparation is often believed of as a tool for the rich. Estate preparation is additionally a terrific method for you to lay out strategies for the care of your minor youngsters and animals and to outline your dreams for your funeral service and favored charities.

Applications have to be. Eligible candidates that pass the exam will certainly be formally certified in August. If you're eligible to sit for the exam from a previous application, you might file the brief application. According to the rules, no accreditation shall last for a period much longer than 5 years. Figure out when your recertification application schedules.

Report this page